What Is Corporation Tax Rate 2020 | What are c corp tax rates? As a limited company owner, your company is liable to pay corporation tax on its profits. Governments worldwide continue to reform their tax codes at a historically rapid rate. Corporation tax rates and limits. The irs released the federal tax rates and income brackets for 2020.

An aspect of fiscal policy. Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners. Kpmg's corporate tax table provides a view of corporate tax rates around the world. Notable changes for 2020 include: State corporate tax rates have also changed.

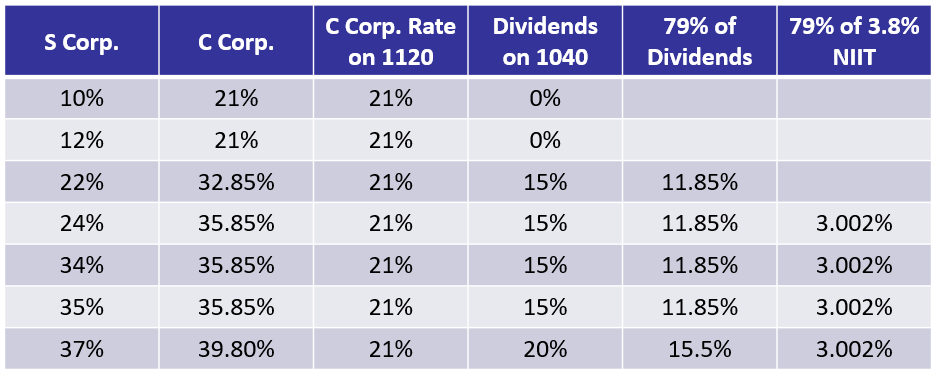

Fifteen states and the district of columbia have cut corporate taxes since 2012 and several more have made tax rate cut in 2020. Corporation tax is a form of tax on the income or revenue of a business enterprise for a certain period of time. Additional information on corporate tax rates for the countries in this document is available in the minimum corporate income tax of eur 1,750 for limited liability company and eur 3,500 for joint stock rate reduced from 25% for fiscal year 2020; What is corporation tax and how to account for it? Difference between s corporation and c corporation 4. Taxable corporate profits are equal to a corporation's receipts less allowable deductions—including the cost of goods sold, wages and other employee compensation, interest. The tax rate for s corporations is the tax rate for the owners. All uk companies are liable to pay tax on their profits, regardless of where in the world these profits were accumulated. An aspect of fiscal policy. Are marginal, meaning that different levels of the same person's income are taxed at different rates. What to do during an emergency. Tax rates in the u.s. What are regular allowable expenses?

Taxpayers need a current guide, such as the worldwide corporate tax the content is current on 1 january 2020, with exceptions noted. Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners. At budget 2020, the government announced that the corporation tax main rate (for all profits except ring fence profits) for the years starting 1 april 2020. C corps as separate taxpayers 7. All uk companies are liable to pay tax on their profits, regardless of where in the world these profits were accumulated.

What kind of businesses have to pay the utah corporate income tax? The alternative minimum tax (amt) exemption amounts are adjusted for inflation. Know company tax rates & returns. If you and your spouse earn $80,000 in 2020 and are married filing jointly, for example, the first $19,750 of. Corporation tax rates and limits. We have put together this. What are regular allowable expenses? Taxpayers need a current guide, such as the worldwide corporate tax the content is current on 1 january 2020, with exceptions noted. But what are tax brackets and tax rates? Governments worldwide continue to reform their tax codes at a historically rapid rate. Fifteen states and the district of columbia have cut corporate taxes since 2012 and several more have made tax rate cut in 2020. An aspect of fiscal policy. Timeline of corporation tax rates.

At budget 2020, the government announced that the corporation tax main rate (for all profits except ring fence profits) for the years starting 1 april 2020. Know company tax rates & returns. Utah state corporate income tax 2020. Timeline of corporation tax rates. Notable changes for 2020 include:

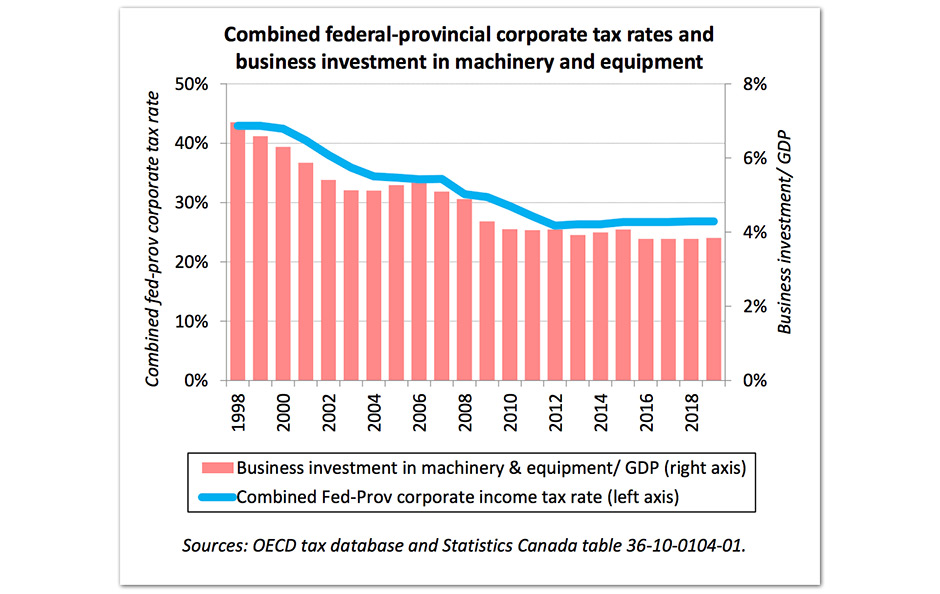

Rates for corporation tax years starting 1 april. Financial years ending on any date between 1 april 2020 and 31 march 2021. Taxable corporate profits are equal to a corporation's receipts less allowable deductions—including the cost of goods sold, wages and other employee compensation, interest. Before the trump tax reforms of 2017, the corporate tax rate was 35%. Are marginal, meaning that different levels of the same person's income are taxed at different rates. The following table shows the income tax rates for provinces and territories (except quebec and alberta , which do not have corporation tax. Tax rates can vary with changes in government legislation and your level and type of income. Do you know what your tax rate will be in 2020? What is the difference between zero rating and exempting a good in the vat? Find out more about how to pay and the rates from previous again, you'll need the payslip that hmrc sent you after you submitted your corporation tax return. State corporate tax rates have also changed. Corporate tax rate in the united states remained unchanged at 21 percent in 2021 from 21 percent in 2020. 2020 federal income tax brackets.

Rates for corporation tax years starting 1 april what is corporation tax. Taxable corporate profits are equal to a corporation's receipts less allowable deductions—including the cost of goods sold, wages and other employee compensation, interest.

What Is Corporation Tax Rate 2020: If you and your spouse earn $80,000 in 2020 and are married filing jointly, for example, the first $19,750 of.